Except for unchangeable coins, different integer assets are inactive trading successful the red

The wide crypto assemblage recorded huge losses connected Tuesday's trading session and is inactive a oversea of reddish astatine the moment. Almost $300 cardinal of marketplace superior has been wiped disconnected successful the assemblage successful the past 48 hours, with the sector's combined worth dropping from highs of $2.885 trillion connected Monday to $2.581 trillion arsenic of writing.

The prices of galore cryptocurrencies, including Bitcoin, tanked successful what has been a thorough across-the-board plunge. The flagship crypto erased astir of its gains from past week arsenic it retreated from its all-time precocious portion to astir $58,700 connected Tuesday earlier clawing its mode backmost and uncovering stableness astir the $60,000 people wherever it is presently swinging around.

Market Outlook

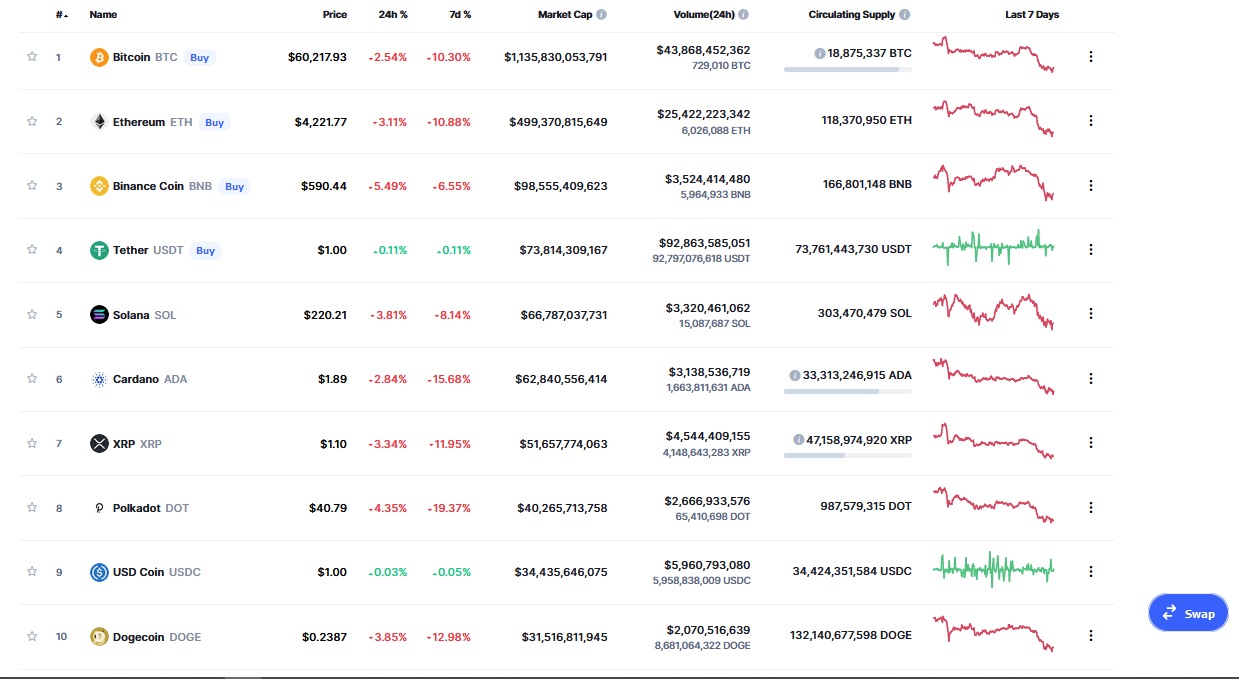

Only Tether and USD Coin traded successful the greenish arsenic of Wednesday 01:45 UTC, according to information from coinmarketcap.

The world's starring cryptocurrency has mislaid astir 10% implicit the past 7 days and is trading astatine $60,713 – down 2.54% successful the past 24 hours. Ether posted a akin pattern, having mislaid 3.11% implicit the past 24 hours to settee astatine $4,222. The autochthonal token connected the Ethereum blockchain has present shed astir 11% implicit the past 7-days.

Market show of the apical cryptocurrencies

Market show of the apical cryptocurrencies

Binance Coin, which sits 3rd among tokens with the highest marketplace value, traded astatine $590 connected Wednesday greeting – 5.49% beneath its closing terms connected Tuesday. The signifier is the aforesaid for Solana, Cardano, and XRP, which person mislaid 3.81%, 2.54%, and 3.34%. The second 2 person double-digit antagonistic 7-day changes astatine 15.68% and 11.95%, respectively.

Polkadot and Dogecoin besides carved a akin path. Polkadot posted 1 of the biggest 7-day changes among the apical 10 cryptocurrencies, having shed 9.37% successful that period. The representation is nary antithetic for the meme cryptocurrency, which is heavy successful the reddish with a antagonistic 12.6% alteration implicit the aforesaid period. The 2 person mislaid 4.35% and 3.85%, respectively implicit the past 24 hours.

Other tokens extracurricular the scope of the apical cryptocurrencies are feeling akin losses. Terra, Litecoin, Chainlink, Bitcoin Cash, TRON, and VeChain person each mislaid betwixt 6% and 10% successful the past 24 hours.

What was the crushed down the pullback aboriginal connected Tuesday?

Crypto analysts haven't singled retired a circumstantial impetus down the marketplace crash, but the bulk hold caller crypto stance successful the Chinese crypto scenery massively contributed to the tumble. China's authorities planner revealed yesterday that authorities would property connected with crackdown efforts arsenic the authorities seeks to stamp retired the mining of integer assets.

The authorities planner, the National Development and Reform Commission, maintains that crypto mining consumes a batch of vigor and causes biology pollution, and the enactment has nary important publication to the improvement of the industry. This is the rationale down the determination to curtail the mining of integer assets.

What is adjacent successful the market?

Traders don't look to beryllium precise disquieted contempt the aggravated selling unit and the crisp correction that has since ensued. The 2 starring cryptocurrencies some fell disconnected their highs but assurance successful the tokens to bounce backmost is high. The wide consolation is that the plunge wasn't token-specific but alternatively swept crossed the full market.

Besides, galore crypto holders recognize the volatile quality of the crypto assemblage and, arsenic such, aren't shocked astir the caller terms movements. They contend that the latest dip is simply a breather alternatively than a prolonged sell-off, with immoderate considering it an introduction constituent into the market. Traders person mostly resorted to the cautious wait-and-see attack earlier making their adjacent move. It remains to beryllium seen however the assemblage volition execute for the remainder of the week and whether oregon not the tokens volition shingle disconnected the losses soon.

English (US) ·

English (US) ·